99% Easy Quotations*

97% Recommend us *

95% Money Saver*

R8 100 300 FINANCE APPROVED TODAY

99% Easy Quotations*

97% Recommend us *

95% Money Saver*

R8 100 300 FINANCE APPROVED TODAY

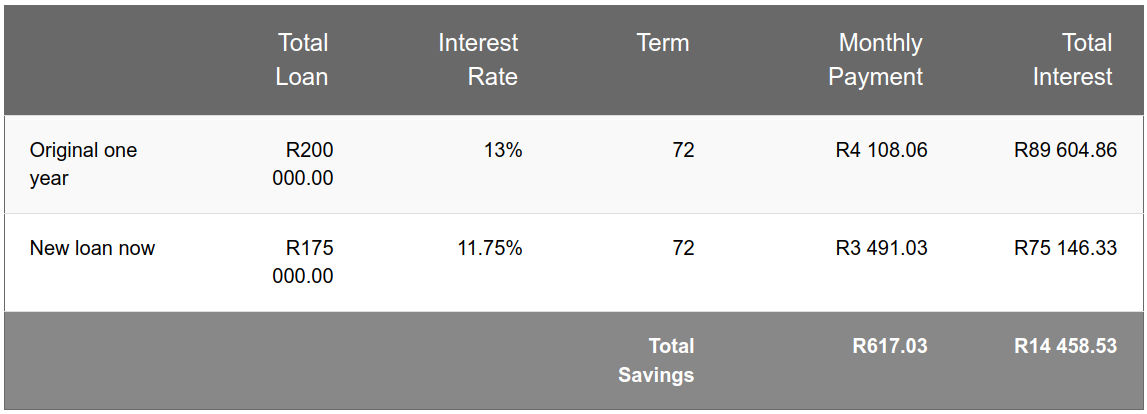

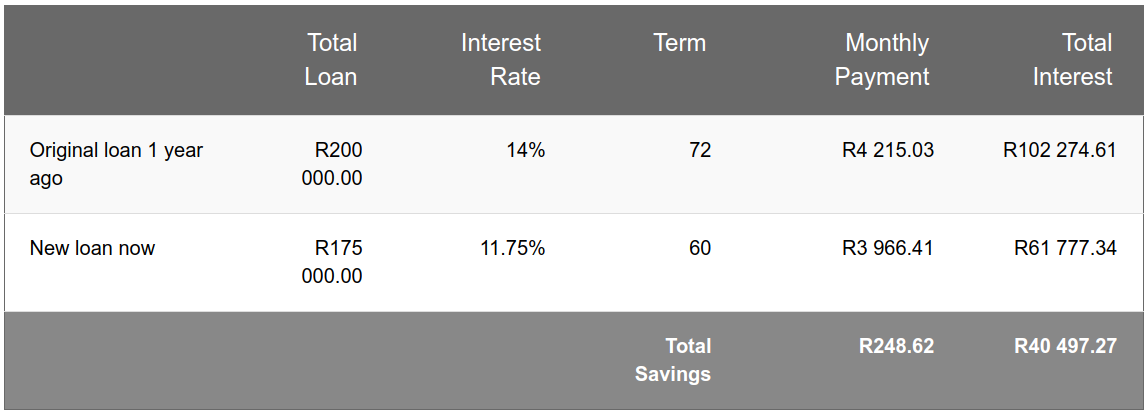

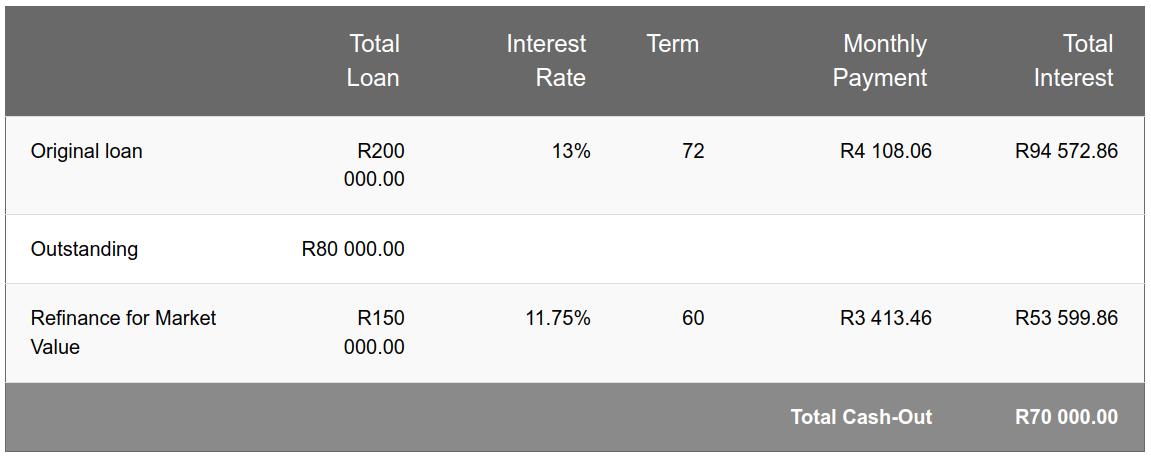

You can reduce your current monthly instalment on your vehicle by refinancing your existing credit agreement. You might have purchased your vehicle with a high-interest rate and you now qualify for a lower rate, this can potentially save you thousands of rands during the remainder of your loan agreement. Another option is to extend the term of your current loan agreement which will also reduce your monthly instalment significantly. To refinance your vehicle you need a healthy credit rating, statistics have also shown that refinancing a car can potentially boost your credit rating as you are settling a previous agreement before the loan term expires.

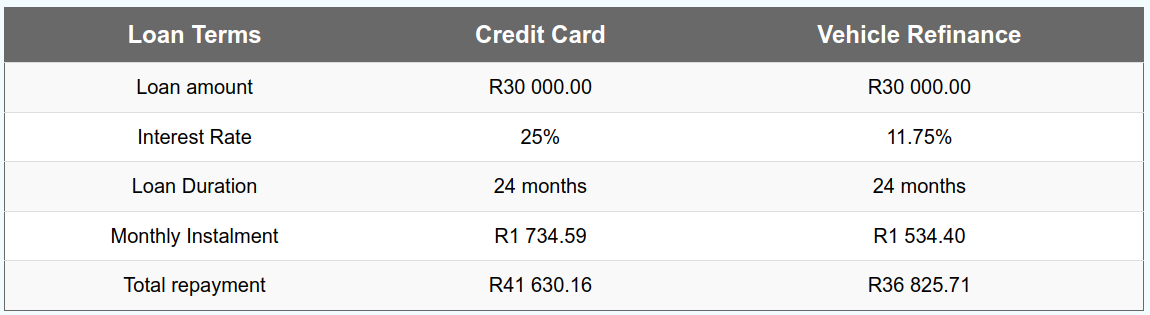

Are you aware that you can save on your credit card debt with the equity in your car?

Below is a good example of how you can do just that by refinancing your vehicle to pay off more expensive credit card debt.